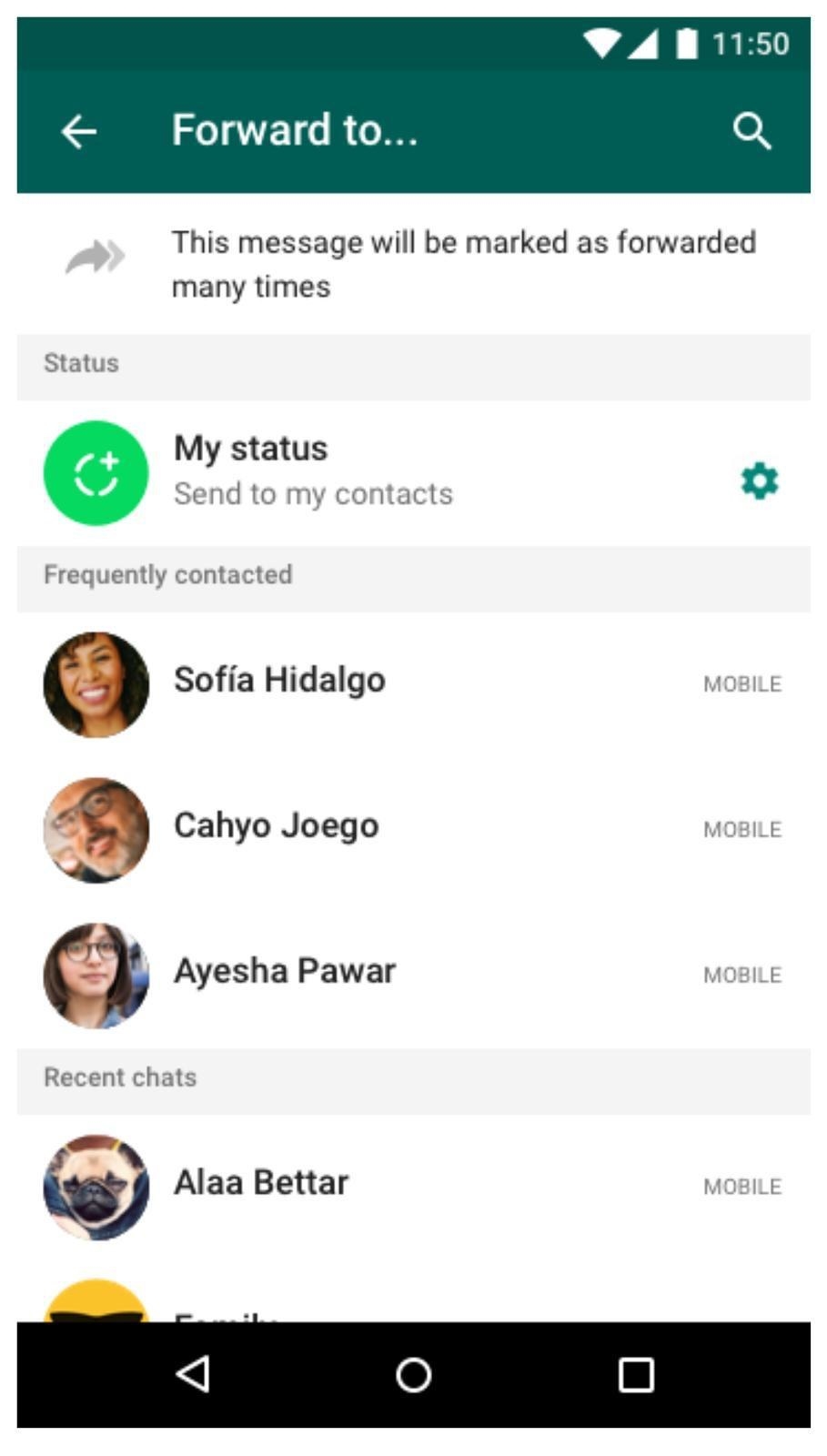

But all of this time and money is wasted when the communications that are the most problematic in an investigation are sent using on an app downloaded for free to an employees’ cell phone. Financial Conduct Authority, arrested 13 employees of the London based FX trading company on suspicion of fraud, conspiracy and money laundering.Ĭompanies spend millions of dollars designing programs to preserve communications and keep pace with ever increasing regulatory requirements, and they invest countless hours creating platforms with the latest technology that allows employees to communicate with customers through secure channels. News of problems at CWM began to spread on March 25th when London police working with the U.K. This development, reported Monday by The Times, is the latest in this highly publicized investigation. According to The Times of London, the founder of CWM, its head of global market analysis and risk, and other staff used WhatsApp to discuss CWM business. The latest example of these risks and challenges is occurring with Capital World Markets “CWM” FX in London, where the London police are focusing on the employees’ WhatsApp accounts as part of a fraud and money laundering investigation.

This presents risks for organizations and challenges for compliance professionals charged with monitoring employee communications and with retaining and searching all of this data to meet regulatory requirements.

In today’s high tech world, the ways to communicate are almost limitless.

0 kommentar(er)

0 kommentar(er)